Today was a much better day for unwinding the positions and the subsequent P/L. I have about 15% of the position(s) left. I’ll probably close most of it out tomorrow. They are fairly benign right now–> Really flat. March expiration is finally approaching an end. How relieving. All in all, I am profitable for March (will know by how much once I finally close everything). I was trading quite large since December (a total of about 100-150 units of 5/-10/5 rhinos) and went through a 20% down move in the RUT followed by several 8-12% bounces. So, having had big money on, I got to experience some of the worst conditions while having the stress of a large position. A nice stress test. I mean, since Dec 31st (when I put it on at RUT 1140) it’s been pretty much the worst environment for trading these things, but they ended up doing OK. My maximum balance swing related to equity was about 12-15% in total and always during the highest volatility days. Of course, I am utilizing portfolio margin, this is why I mentioned the swing relative to equity. A few days after a high volatility day, RUT at same price, my balance would be right back to normal. Those are the effects of volatility on option pricing. Anyways, I can deal with that and I pretty much have a skin of steel now. I never felt totally uncomfortable through all of this despite the volatility and that’s a big change from the old modified iron condor days–>especially Aug 24 (I was extremely uncomfortable that day)! Glad I don’t trade that anymore. It must be a very challenging year for condors (well all trades are having difficulties, I see a lot of M3 traders doing poorly right now).

I did learn things I probably won’t do again, first and foremost, I will always close the Rhino structure if it gets challenged rather than trying to hedge it. As well, I’ll probably use upside BWBs as adjustments as opposed to calendars. I didn’t like how the call calendars reacted these past few weeks and I’ll be backtesting some of this later this week.

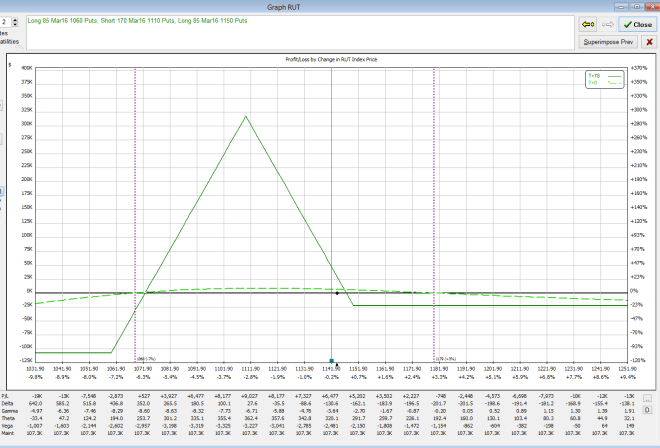

The bearish butterflies were a beautiful trade this month. They did fantastic. I just closed out most of them for a big profit. I had continued to put these on as hedges all the way down. What I’d do is put them on patiently after every modest bounce and I’d always get fantastic pricing on them and they were resilient on the way back up.

Other than that, I am waiting for a good day to get into the May trades. I didn’t like the pricing on Friday.

EDIT: I closed off my 1040 call calendars for 10.35 today when RUT was at 1040. I paid like 9 something for them at like RUT 1015…really?? I made $1 on it? Not exactly a great hedge to the upside. Anyways, I really got to look at calendars. Right now, I am just going to start using BWBs. It could have been because I put the calendars on late in the month.