Not much to say. Trade requires no adjustments. Yesterday night the futures ramped up hard (about 1%) and today we saw all of the gains dissipate and the RUT is hanging around 1090 again. The trade is up ~5k on 250k planned capital. Being farther out makes this trade quite resilient. I am eyeing up an early entry on December M3 (77 DTE) we can get the BFs for about $7 and we can do a 30 lot with 1 call. Large downside protection and we can scale out of the BFs as time goes on and if we have any upside issues.

Tag: john locke rock trade

Sep 30 – November M3 Update

The November trade requires no adjustments. It’s sitting nicely and with profit. Should be quite resilient to the downside for the next few weeks. We’ve got a lot of room for movement. On the upside, we’ll need to watch our negative delta and with any collapse in volatility that line will sag and we’ll need to adjust.

Sep 25- M3 Trade

No adjustments needed today. We’re slightly delta negative which is where I’d like to be as it gives cushion in a market fall re increased volatility. Since we’re a vega negative trade, any increased volatility hurts the trade. We’ll adjust on the upside once delta reaches -500 within the tent and -350 or so outside of the tent. As the market goes up, volatility tends to drop, and this will cause a sag in the T+0 line on the right hand side of the graph. We want to monitor this and usually we’ll add put credit spreads ATM to address and eventually, if it sits for a few days outside of the tent to the upside, we’ll roll the butterflies forward.

Sep 24 -Trades

On Thursday, the RUT touched 1194 and then proceeded to fall to 1125 within 4 trading days. What’s 70 points between friends. I am starting to get used to this volatility. It’s a lot easier to handle with these M3 trades. However, some of the October trades I had on had to be adjusted today because of the big drop. 70 points is a lot and our gamma trend on the downside was getting a tad uncomfortable and some of the trades had hit delta limits. With one trade, I went well past the limits in the AM so I adjusted early (I am trying to adjust once a day at 2:30pm) but I felt I had to do it on this one. No biggie but a bit of an annoyance. I adjusted in the AM once and again around 2:30. I had some gamma trend issues on the downside and corrected these. Apparently my timing was not impeccable as the market rose after I did the adjustments. That’s part of the game. These occurred while RUT was around 1128-1132 today. It’s now at something like 1138.

I’ve now entered an M3 trade for November which I’ll post here and can be followed on a day to day basis. Here it is:

It’s an M3 with a mix of 1110s and 1100 Butterflies. Each day I’ll post the current P/L and adjustments. It’s a 5 lot with planned capital of 250k trade with a profit target of 25k and a max loss of 25k. The actual at risk amount is significantly less than 250k but that’s our planned capital amount and what we base the returns off of. Standard M3 stuff. You may end up using all 50k but most of the time its not. You have to plan for it though. Adjustments etc cost.

I added 1110s a day or two ago and I filled it out today with some 1100s. The price of the BFs were quite low and less calls were needed to hedge. We’ll have to keep an eye on the upside trends. This will be a first official trade for this blog and I’ll be posting all adjustments and results day to day.

Trade Plan – Sep 24

The market is going to open down slightly today at some major ES supports (1910-1915) with more support at 1898/1900. If we have a close below 1898, then we can expect a retest of the lows at 1880. If it can get above 1915, then I expect a retest of the 1940/1950 level. Yellen speaks today at 5pm EST and likely the market is going to putter around until then. I’ve got some adjustments to do today on the M3s for October and I’ll be looking to enter November trades.

The protector is down about 1.9% now vs SPY down about 6.2%. The protector lost a lot of value from Sep 8 till present due to the volatility collapse coming out of the long puts. The hedge part of the trade was what caused this loss. During the week of the correction, the protector was actually up about 1% due to the volatility in the longs. It did what it was supposed to do but the weeks following, as the fear leaves, the hedge starts to normalize and we experience some of that initial hedge gain dissipate. This is what is happening now.

The options trades have gained well during the past two weeks and we’re starting to go risk on today and tomorrow which might be good timing with this increased volatility.

Sep 17 – Fed Day

Today’s the big day. I am positioned with very little upside risk and about 5% room on the downside via a series of M3s. Though, one of the 1120 M3s are now vega positive and if volatility decreases it’ll sag the T+0 line a bit which will cause me some issues. Nothing too risky at all. I plan to up my risk going into October and have been waiting for the market to settle down. I added a few 1150 M3s today since the volatility is still high and we can get them at a nice cheap price given the time till expiry. Again it’ll handle all upside moves well and has a good 5% to the downside before any issues.

The RUT has moved up quite substantially in the last few days (up nearly 50 points! which is near 4%-5%).

5 min to go. Can’t wait for this meeting to be over with and for some normalcy to return to the markets.

The alpha protector is down on the recent rise as volatility flew out of the long puts. I was somewhat expecting that. As it gets passed 204-205 we’ll see profits return. I rolled up the shorts today from 201 to 203 to give more upside room.

Sep 14 -Trade Plan

I removed most of the September trades today. I have a little left but not much. Somewhat a small recovery these past few weeks enough to get back some confidence. The losses now are more stomach-able. Having realized how drastic the moves where and how little they occur in history has relieved me. I’ve lost a summers worth of profits on an event about as rare as 1 in 10 years. Not bad. Soon come, I am ready to get back on the horse. I have a renewed focus on proper risk management and diligence in preplanning and back-testing. I’ve been spending most of my free time doing due diligence and backtests galore.

I’ve got just a little risk on for October trades as I await the Fed meeting on Thursday. I want things to kind of settle down (which it is starting to!) before going back full risk-on. I needed a small break from the stress of it all as well.

Obviously the recent events were somewhat traumatic. The drop of 10% in four trading days is quite rare. It’s only occurred 9 times since the Great Depression. The other times it occurred was of course Aug 2011, Oct 2008 (Financial Crisis), Aug 1998 (Long term capital hedge fund explodes), Oct 1987 (Black Monday!), 1962 (Kennedy intro’s steel tariffs), 1940 (WW2), 1938 (Fed policy error). Source: Doug Kass

The neat thing is that every single one of those had a retest of the lows within a few months. Only two of the above occurred in bull markets (which we are pretty much in now). They eventually went on to new highs (one took 5 months and the other took four months). Again, source: Doug Kass

If we retest the lows at 1875, I’ll be putting some risk on. In the meantime, I’ll be adding M3s and Bearish butterflies periodically and ramping things up. The high volatility environment should be quite lucrative in the months to come. We’re finally getting paid for our risk!

The protector is just about break-even (maybe slightly profitable). Pretty damn good since we put the thing on at SPY 205 and SPY is at 195 (5% down ish). But I am worried that the next few years, the environment may not be good for a long based portfolio even when hedged. I don’t know what to do. I think its probably prudent to just keep it on and let it run its course over the next few years. The mechanical stock picking should keep things profitable as it has to date. Eventually, it’ll do quite well. It’s a long term portfolio.

Sep 12 – Trade Plan

This month has been the third most volatile month for the markets in history only being beat out by the 2008 financial crisis and the 1929 great depression. The overnight moves were extreme and made for the toughest markets for market neutral trading. Overnight gaps in each direction in the 1-4% range were regular and intense and quick reversals came at the drop of a dime. Going from an extreme low volatility environment to an incredibly high one is always going to be very challenging period for market neutral traders. Once in a high volatility period, it’ll be much easier to manage and probably a lot more profitable but the transition can permanently take out a lot of traders 🙂

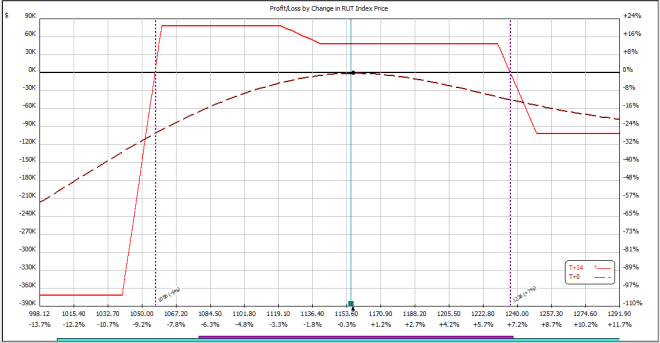

I struggled immensely the past few weeks but finally had a decent week with some recovery. The MICs do not trade well in this environment and can be devastating in unexpected overnight crashes. The RUT moved from all time highs to about 17% down in the period of a few weeks. Crashes like what happened on Aug 24 will wipe out most iron condor traders. Luckily, those events are quite rare. If it happened during trading hours, it’d be a lot easier to manage. A study was done and it was found that 50% of the markets movement occurs in the futures between 3-4am during the past 7 years I believe. The market is more efficient and swift than in the past and I believe that it’ll make MIC trading a lot more difficult to manage than back-testing would suggest. In contrast, all the M3 traders I know are mostly positive (one is up 7%) and, remember, it’s still a market neutral trade that really doesn’t like movement. Yet it survived one of the most volatile months on record. That’s incredible. I’ve had a bunch of M3s on but not enough to even make a dent in the MIC losses. It’s a very resilient trade as you can see with the below risk profile.

M3’s can handle market movements a lot better. Here is an example of an M3 risk profile:

The beauty of an M3 is how it compliments human factors. When I say human factors, I mean psychology and the things that challenge us within when trading. Things like taking losses with adjustments, or the opposite, adjusting to quickly out of fear etc etc. If you notice, you have no real upside risk and on the downside, you’re falling into profit being under the tent. So when you make an adjustment on the downside, you’re up money AND you’re usually taking money off the table. That’s a very nice adjustment in terms of human factors. As well, look at the room you have before you start losing money (almost what 5%?). Again, the beauty of managing this trade is its conservative risk profile, the fact that adjustments are mostly welcomed, and that a trader who’s keeping their T+0 line balanced will usually never have a problem with deviating from the plans so greatly that it affects the trade overtime.

Here is an MIC risk profile.

You can see that on a quick fall (overnight) without the ability to protect yourself, you can have extremely large draw downs. This is especially pronounced as you get closer into expiry. Plus, this risk profile is taken in a high volatility environment, having put this on during Aug before the correction, it’d be even worse. That said, if you had the ability to adjust (moves happen DURING the day instead of overnight), then this trade is easy to manage. Overall, I mean, I loved the MIC trade until this month. I had a really rough month in the melt up in October of last year and I had a real rough month this month with the extreme overnight movements. For me, I just don’t know if its a trade that I can justify having seen how the M3, Rock and Bearish butterflies react. I mean, the MIC is a great trade for the most part, as you have quite a high theta and being in the green each month had a 93% success rate. It’s the extreme moves that occur overnight that really hurt and excessive whip saw. Both of those causes are what hurt me in the MIC trades recently. In hindsight, I should have closed the MIC straight away instead of trying to manage it through the week after crash. Hindsight is 20/20.

Sep 4 – Trade Plan

I had to take a break from posting. Those two weeks were probably the worst two weeks I’ve ever experienced. Managing the trades in this transitionary environment (extreme low volatility to extreme high volatility) has taken me to task and almost made me quit. We did terribly these past few weeks. Our MICs were utterly destroyed in the Monday correction and further the adjustments made (a mistake in hindsight) as the market moved 5% consistently over night in each direction several times.

We’ve got a few things hanging over the market right now and that is the fact that Chinese markets are open 2 full days before the US markets re labour day and the likely Fed rate hike on Sept 17th. Those two things are keeping options pricing very expensive. Being a market neutral theta decay based trader having originally been paid shit in a low volatility environment has been the biggest challenge. We’re experiencing 3-5% moves overnight and we’re getting no time decay. You literally cannot get a worse time for these trades and I have regrets in the management of the trades during the period. Though, I do realize most of these regrets are regrets in hindsight. I couldn’t have known the market would go green nor could I have let things ride the way we were positioned. All in all what an epic learning experience. I have weeks of data and thoughts to go over. I need to take this experience and learn everything I can from it.

As market neutral traders, we try to manage risk by making adjustments, but if we are constantly adjusting in each direction, we get killed. This means that we usually have to change the way we make adjustments (less frequently) but that exposes us to gamma risk if the market runs in one specific direction. My plan is to sideline the majority of my risk until after the 17th and wait for the market to calm down a bit then enter good solid trades and start the recovery process. As well, if we get a crash, I WILL enter some trades to take advantage of that (with great risk reward). This gives us the best odds for a smooth recovery. A few good months should get us back to where we were.

I tried to do the best I could at the time but I would do things differently. I opted to adjust pretty much when it was too late. I should have exited the MIC trades and took the loss. Instead, I adjusted and those adjustments cost me more than my planned loss as the market whip-sawed up and down in very large amounts. Each one taking more and more $. Taking a max loss isn’t just taking it for the sake of not having more, but the fact that you are at a max loss also means that the market is doing things it doesn’t usually do –> it’s not behaving rational or within normal parameters. That in and of itself is the main reason to just exit and wait. Given the conditions and what I saw in option pricing and market behaviours and how each strategy reacted (PUTS didn’t even have an ASK price during the morning!!) I learned so much and have so much to study about what happened, that it’ll make me a much better trader. I’ve now got an extreme melt up and an extreme melt down under my belt 🙂

So yeah, the transitionary period is the absolute worst thing we could have experienced (going from extreme low volatility to extreme high volatility) because we simply never got paid for the risk before the high volatility period. It’s no problem once we’re in high volatility and we get paid appropriately. However, that said, any EXTREME volatility market that was preceded by some sort of black swan (Yuan devaluation) will always be somewhat catastrophic for these types of trades. The event that we experienced is a 1 in 7 to 10 year event. We are still in an extreme volatility period while we navigate the devaluation issues and the potential fed rate hike on Sept 17th. This exposes our trades and I’ve reduced risk going into the weekend though not completely.

I felt so often to just quit but I’ve realized that I just went through a crash period that will be so invaluable to my experience in the future that I have to buck up and approach this as an opportunity to learn from direct experience in something that is such a risk but are experienced quite rarely and sometimes only once in someones options trading career.

Oh by the way, something super cool –> The protector alpha did not actually lose any capital throughout the crash or days following. We entered it at around SPY 205-206 and it was insured for that level. SPY went up to 213 and of course we had profits wiped out but we never lost capital. Now that is insane. We are at SPY 192 and we’re break-even. The market corrected 10% and our basket of equities were in fact 100% hedged. We participate in upside but not downside. Had we rolled our insurance, we’d actually be profitable.

Aug 23- Trade Update

That was a week for the history books. Oil had its largest weekly fall since ’86. Vix went up 47% in a week which is the highest in all history. The speed of the decline was also extremely unusual. I’ve read that perhaps the market cycles will be more square like rather than Sine like due to the efficiencies in this age (information hits markets instantly). Anyways, this decline reminds me of the up movement in October. These things are happening over night and giving no-one time to adjust. It makes for managing time decay based strategies quite difficult.

The protector portfolio is actually still up just shy of 1% while the SPY is down 4%. The equities were actually still up 2.5% but the hedge is down about 1.5%. So its outperforming SPY by about 5%. Nice. However, this last very swift correction has told me that I have have too much downside exposure. The MIC does not like increased volatility and sharp down moves nor does the protector. These were my leading strategies up until about a few months ago when I added the M3 and Bearish butterflies. Both of these have held up and are still mostly profitable though bruised from their specific highs. I’m leaning too much re risk to the downside and I need to adjust the ratios of the strategies. I’ll probably reduce the Protector to about 15%, the MIC to about 15% and the M3 to 50% and do the Rock trade and opportunistic Bearish Butterflies with the rest.

Like I said above, though, I know exactly how the protector would perform in a sharp down move, I’ve decided I am not comfortable with the downside exposure when coupled with everything else and how it affects my downside risks. Having two strategies go sharply down at the same time is not a great feeling and adds unnecessary stress. So I’ve decided to start working on lessening the ratio of these strategies within my own portfolio. I won’t be doing this reduction willy nilly but timed appropriately. The strategy does well, I mean it’s still up it’s just doesn’t fit well within all the other trades.

The RUT trades are down about 4-5% during that last fall. I imagine at least half of that is stuck in the prices of the options re volatility. Remember, the RVX/VIX are at extreme levels. That means that the options are priced with a lot of premium. The same options we sold. So the trades appear quite down. As time gets closer to expiry this volatility has to flow out and we’ll continue to maintain appropriate risk. Ideally, we don’t correct much more than a few more % before a strong bounce.

The SPX MIC trades are down 9%! This is expected as the SPX was the most dramatic collapse of the two. It fell 3% on Friday while the RUT only fell 1.1%. Any bounce should recover the trade to at least 4% down and we’ll do a larger adjustment then while maintaining appropriate deltas if we should have more down Monday. As we close in on expiry, I’ll be doing my best to get these things back to break-even. I’ve done it 2 times before during a correction. It just takes appropriate risk management and a level unemotional head 🙂

Overall, as of right now, with the options volatility at extremes and thus the option pricing also at extremes, when we look at all Aug (already posted results) and Sep trades, we are down about 2-2.5% overall. Not bad considering the events and also not bad since it is quite likely we will recoup a lot in the Sept trades. The trades weren’t designed really to withstand a furious drop with 80% of the downside happening after hours. Unfortunately, you can’t design a trade to weather all storms.

As I am following market news right now, I see that the bank of China has indicated that they are lessening reserve requirements, S. Korea and N.Korea have de-escalated the skirmish and Iran has requested an emergency OPEC meeting to combat the falling oil prices. This might be the bullish catalyst to spur a furious bounce. We shall see. A bounce would certainly be nice for the protector and also to adjust the MICs.

Update: In an effort to curb the fall in the markets, China is going to allow pension funds to invest 30 % of its assets(546 Bln) in the financial markets and that includes all sorts of financial instruments. Let’s see if the Shanghai composite holds that 3500 level and we see a bounce.